Finding The Right Coverage Doesn't Have To Be So Stressful!

Health insurance decisions can feel complicated when plans and terminology appear similar but function very differently once coverage begins. Many people begin researching coverage only after experiencing a life change such as leaving an employer plan, becoming self-employed, or needing coverage for their family. The goal of this page is to explain how health insurance works in practical terms so you can better understand your options before making a decision.

Rather than focusing on technical definitions alone, this guide explains how coverage functions in real-world situations. Understanding the structure behind health insurance makes it much easier to compare options and choose coverage that continues to work over time.

Interested In Free Insight To Health Insurance?

Check Out Our Catalogue Of Insight Articles!

We're constantly putting out more and more information about health insurance so that anyone who might be in need of coverage can enter the conversation better informed. Getting the coverage that you actually need is always easier when you know what you're walking in to.

Health Insurance Based on Life Situations

Health insurance needs often change based on life or career transitions. Understanding which direction typically fits your situation can make the decision process easier.

Leaving Employer Coverage

Individuals transitioning away from employer-sponsored insurance often need to replace coverage quickly while maintaining access to preferred doctors. Personal health insurance options allow individuals to select coverage based on their own needs rather than employer plan structures.

Common Misunderstandings About Health Insurance

Many frustrations with health insurance come from misunderstandings rather than lack of options. A lower monthly premium does not always result in lower overall costs if deductibles or network limitations make care difficult to access. Similarly, plans that appear identical on paper may function very differently depending on how often healthcare is used.

Another common misconception is that choosing coverage is primarily a price comparison. In practice, provider access, network flexibility, and how coverage works during actual medical situations tend to matter more over time. Understanding these differences before enrolling helps avoid unnecessary changes later.

Where to Go Next

If you are unsure which type of coverage fits your situation, the next step is identifying the coverage approach that best matches your needs.

[ Personal Health Insurance ]

[ Family Health Insurance ]

[ Self-Employed Health Insurance ]

[ Small Business Health Insurance ]

If you would prefer to review your situation directly, you can also schedule a consultation to discuss your options and receive clear guidance before making a decision.

Free Health Insurance Consultation

How Health Insurance Coverage Works

Health insurance is built around a few core concepts that determine how care is accessed and how costs are shared between you and the insurance company. While plans may look similar at first glance, small differences in structure can significantly affect how coverage works once medical care is needed.

Provider Networks

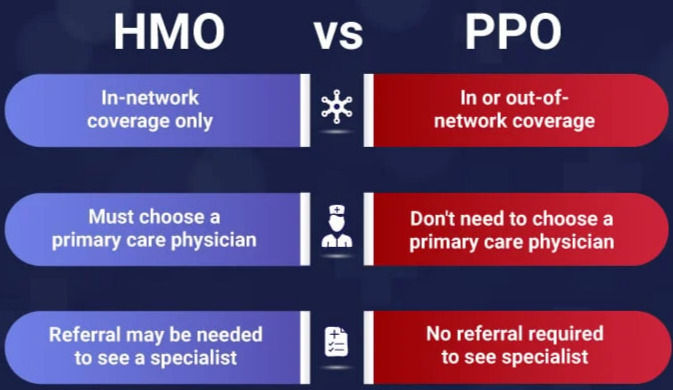

Most health insurance plans operate within provider networks. These networks determine which doctors, hospitals, and specialists are considered in-network. Plans with broader networks typically offer more flexibility in choosing providers, while narrower networks may require referrals or limit where care can be received. Understanding network structure is often more important than comparing premiums alone.

Deductibles and Out-of-Pocket Maximums

A deductible is the amount paid before certain benefits begin, while the out-of-pocket maximum represents the most you would pay during a policy year for covered services. These two numbers work together to determine how predictable coverage feels when care is needed. Plans with lower premiums may have higher deductibles, which becomes more noticeable when healthcare usage increases.

PPO vs HMO Plan Structures

PPO and HMO plans differ primarily in how care is accessed. PPO-style plans generally allow more flexibility when choosing providers and do not always require referrals for specialists. HMO plans often require care to begin with a primary physician and may limit out-of-network coverage. The right structure depends on how you prefer to manage healthcare rather than which option appears less expensive initially.

Marketplace Vs. Private Plans

Marketplace plans provide standardized coverage options and may offer subsidies depending on income eligibility. Private health insurance options can offer alternative network structures or flexibility depending on individual eligibility. Understanding how these approaches differ helps prevent confusion when comparing plans that appear similar on paper.